Image : http://www.flickr.com

Vehicle insurances serve is your protection against accidents when driving along the road. It is now a legal requirement or made compulsory to many jurisdictions for both private and commercial vehicles. The protection it gives varies on the kind of policy you are into. Auto insurance should matter to your personal lifestyle and vehicle needs.

Purpose

Auto insurance is designed to pay out the third party when injured in an accident by fault or damages because of fire, wind and water.

Coverage

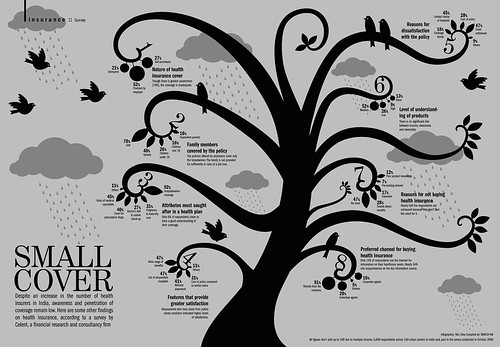

Vehicle insurance can cover the insured party, insured vehicle and third parties. Other states can also cover injured persons riding inside at the time of the incident regardless of who was at fault. There are certain policies that specify situations like fire damage and theft. Different levels of insurance coverage are also available. Higher levels can pay for repairs depending on the choice of policy. There are many types of insurance coverage and some are discussed below.

Full coverage is referred to as Comprehensive and Collision. It implies much broader coverage than existing ones. Collision Coverage is for insured vehicles involving an accident. It provides payments for repair or a cash value payment if not repairable.

Comprehensive Coverage (other than collision) provides insurance for vehicles damaged by incidents not considered collisions. Comprehensive losses include fires, theft, weather, vandalism and animal impacts.

Underinsured Coverage is known as UM/UIM that provides an at-fault party either with insurance or not. The insurance company will pay your medical bills. Loss of use Coverage is known as the rental coverage that provides reimbursement on its expenses. It is associated with the insured vehicle being repair due to a covered loss. Loan/lease payoff coverage is sometimes also called GAP or GAP insurance. It provides protection to consumers based on the market trends. Towing Coverage is the Roadside Assistance Coverage. It pays off accidental and non- accidental related towing. Non-accidental covers mechanical breakdowns, gas outrages and flat tires.

Policies include a legal cover and a personal injury. Personal items inside the damaged vehicle are not covered here. One needs to fully understand the policy documentation before committing into a particular policy to avoid choosing the wrong plan.

Factors affecting its premium cost include the amount you pay, the level of cover you choose, the type of vehicle, your address and age and more importantly the auto claims in the past. The age of the vehicle is usually looked into also. The older the car without residue value the easier it can acquire basic liability coverage.

Unmarried drivers are often charged with higher insurance premiums than married ones. Insurance companies may even look into your credit and driving records before giving their rates.

Other options to choose from is based on your budget needs like the comprehensive coverage, collision coverage or its combination and coverage against a particular incident. To ensure that you want to keep the cost much lower, it is better to go on the highest deductible to reduce your premiums. Comparing different policies and prices is a flexible way of ensuring the right payment terms.

Car insurance really matters when it comes to your protection, physical damages and saving you more in a right perspective. Your car is your responsibility this is why it is better to understand the insurance purpose, coverage, prices and liabilities. This will benefit you in the end.

Visit : Digital Frame Hipmore Blog